Mobile Deposit

Make deposits from your phone!

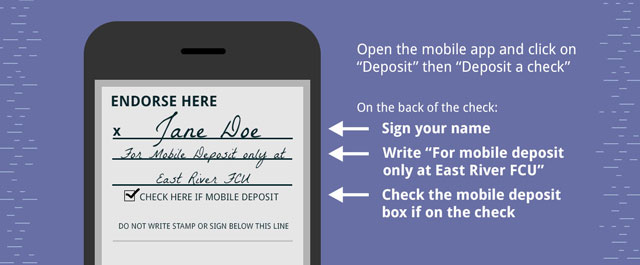

ATTENTION! Make sure you endorse the check properly:

1) Sign the check.

2) Write "FOR MOBILE DEPOSIT ONLY AT EAST RIVER FCU" below your signature.

If the check in not properly endorsed, it may be rejected at the discretion of East River FCU.

Mobile Deposit is accessible through the East River Federal Credit Union Mobile Banking app and provides a simple, secure way to make deposits to your Savings or Checking account. A link on the mobile app allows you to take a front and back picture of the check you would like to deposit, whenever or wherever it's convenient for you.

How do I access Mobile Deposit?

To get started with Mobile Deposit, logon to your Mobile Banking app and locate the Deposit tab.

In order to use Mobile Deposit, you will need the following:

-

A compatible smart phone (Android or iPhone) with internet access and a camera

-

An Online Banking account and the East River FCU Mobile Banking app

-

A valid East River FCU Savings or Checking account in good standing

Which East River FCU accounts accept Mobile Deposit?

Currently, mobile deposits can be made to a Savings or Checking account. Health Savings accounts are excluded.

When will my Mobile Deposit by credited to my account?

Deposits made before 12:00 p.m. CST on business days will be credited after 3:00 p.m. CST on that same business day. Deposits made after 12:00 p.m. on business days will be credited the following business day, after 3:00 p.m. CST. Credit union holds may apply.

When will my Mobile Deposit be available for use?

Funds from most deposits made through Mobile Deposit will be available on the second business day after the day you receive credit for your deposit.

If you make a deposit before 12:00 p.m. CST on a business day, we will consider that day to be the day of deposit. If a deposit is made after 12:00 p.m. CST on a business day, the following business day will be considered your date of deposit.

What is the deposit limit?

The daily maximum deposit limit is $2,500.

Can I deposit multiple checks?

Yes, multiple deposits can be made one check at a time.

How long should I keep my checks after I deposit them?

Checks deposited using Mobile Deposit should be securely retained for 90 days. After that time, the original check should be destroyed.

What types of checks are NOT allowed to be deposited with the Mobile Deposit feature?

-

Checks greater than $2,500

-

Checks payable to cash

-

Checks in foreign currency or drawn on a foreign bank

-

Postdated checks

-

Unsigned checks

-

Third party checks

-

Checks without a valid endorsement on the back