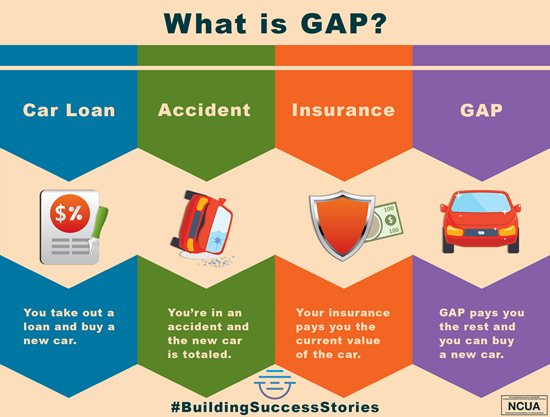

What is GAP Coverage?

Many who hear the word GAP might think of a popular clothing brand. But in the financial world, GAP (or Guaranteed Asset Protection) is an affordable way to fill the gap between the book value of your vehicle and your vehicle loan balance. In simple terms, should you get in an accident and your vehicle get totaled, your insurance will likely only pay what your vehicle is currently valued at. This amount may not cover your loan balance on the vehicle. GAP will. East River FCU offers both GAP and ADR (Auto Deductible Reimbursement) to our members. ADR will help cover out-of-pocket expenses, such as your insurance deductible, when you have an accident or mishap with your vehicle.

Dennis, a loan officer at East River FCU says, “I love telling members about our GAP/ADR product. I love talking about the Auto Deductible Reimbursement portion of the product. First, it covers any car or truck that has the member on the title and has full coverage. It reimburses up to $500 of the deductible for UNLIMITED accidents for 3 years. This includes hail damage, broken windshields, “deer” damage, etc. I personally saved $2,000 in deductibles in 3 years thanks to this product. For pennies a day, you can save a lot of money.”

Adding this extra layer of protection to your vehicle investment is easy and inexpensive. East River FCU loan officers will always work with you to find the most savings during the loan process. Is GAP/ADR a right fit for you?

Guaranteed Auto Protection