A better card experience is at your fingertips

Do even more from a single convenient platform.

My Cards in our mobile app puts more control, convenience and safety in your hands. From better card controls to clearer merchant transaction info, now you can do even more from one convenient place. Read all about these great features below!

Download the Cheat Sheet (PDF)

With the My Cards dashboard in your new and improved mobile app, you can:

Feel More Empowered. Control your cards on your terms.

-

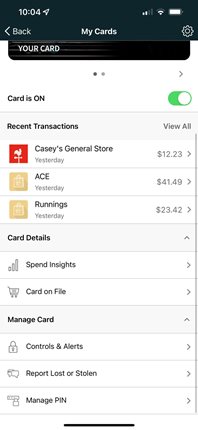

Turn your cards on/off at your discretion.

-

Know what merchant your card is stored with.

-

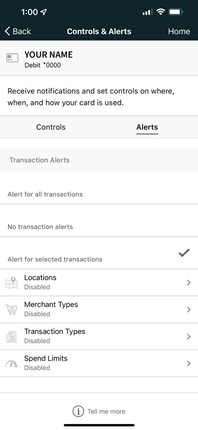

Set spending limits based on location*, amount, merchant type and transaction type.

-

Set alerts that instantly notify you of transactions.

-

Parents can decide where, when and how teens can use their card.

* Please note all international transactions are blocked automatically by the credit union. If you use "Location Controls" to block international transactions and add a country exception under Travel Plans, you still must contact ERFCU to approve transactions in that country.

Find more clarity with deeper insights into spending.

-

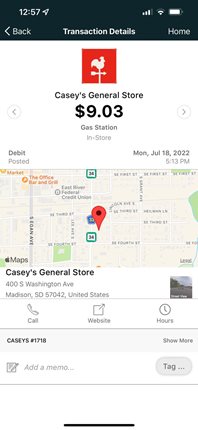

Gain total transparency into every transaction with clear merchant names.

-

Keep track of spending with a glance.

-

View merchant name, exact location on map, and contact info.

-

View spend by what, when and where.

Feel more secure and use your card confidently with uncompromising fraud protection.

-

Report lost or stolen cards in a couple clicks.

-

Immediately turn off a lost or stolen card from your phone.

FAQ's

General

What enhanced card management options are available within the Mobile Banking App?

Our enhanced card management options, My Cards, allow you to:

-

Lock/unlock your debit cards

-

Limit transactions by location, merchant, transaction type or dollar amount

-

View subscriptions tied to a card and see where your cards are store at online retailers

-

Stay informed with alerts

-

View your spending via easy-to-read graphs

-

Get in-depth transaction details

-

Report lost or stolen cards with click to call

-

Quickly identify and report fraudulent transactions

-

Reset your PIN easily with click to call

How do I get started?

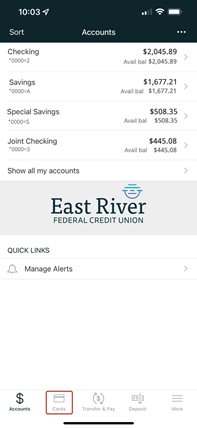

Simply log in to our Mobile Banking app and tap on "My Cards" to get started.

Can I add other financial institutions' debit cards or credit cards to the Mobile App?

No, only our institutions debit cards are supported.

Can multiple cards be linked to one Mobile Banking Account?

Yes, multiple cards for our institution can be accessed.

What if I receive a reissued or replacement card, will I have to update the card within the application?

No, the card should automatically be updated within the Mobile Banking app.

What if I don't see "My Cards" in the Mobile App?

Verify in your App Store that you have the most current version of our app installed. If an update is needed, you will see "Update" in the App Store.

Transactions

What type of transactions are displayed?

Transactions made with your cards are enriched and displayed. Teller transaction, wire transfers, and payments made via Bill Pay and ACH are not included under "My Cards".

Does the app show recent transaction history?

Yes, the app shows the last 50 card-based transactions posted within the last 30 days.

A spend limit of $50 has been set, but my card gets denied at some gas stations. Why?

Sometimes a merchant will pre-authorize the card for an amount that may be more than the spend limit you allow on the card. In this case, your card will be denied.

What's the difference between "Card on File" and "Recurring Payments"?

"Recurring Payments" are those payments that happen repeatedly on a schedule, for example, streaming subscriptions, cellular bills, or other monthly bills you pay with your card. "Card on File" is a list of merchants who store you card information for future purchases, like online retailers or delivery apps.

I see a transaction I don't recognize. What should I do?

Select the transaction to view its details. If it was an in-person transaction, you should see a Google Map of the actual location the transaction took place. If you still don't recognize the purchase, you can reach out to the merchant from the phone number listed on the screen.

Controls and Alerts

What card controls are available?

Via our Mobile app, you can lock or unlock your card if you suspect fraud or misplaced your card. You can even report lost and/or stolen with our click to call. Limit transactions by location, merchant, and transaction type to control how your card is used. Plus, set up alerts to stay informed.

Will changing location controls, merchant controls, and spend controls impact previously authorized recurring transactions?

Previously authorized recurring payment will be affect by the card controls.

How long does it take for a control or alert setting to take effect?

Control settings take effect immediately.

How are alerts delivered?

Alerts are sent as push notifications on your device. The alerts will also appear under "Messages" in the app.

If I set multiple alerts and a transaction triggers more than one, will I receive separate messages for each alert?

No, alerts will be all included in one message.

Data charges may apply. Check with your mobile phone carrier for details. App Store is a service mark of Apple Inc. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Android, Google Play and the Google Play logo are trademarks of Google Inc.

.